Goodwill vs. intangible assets: what do they mean for a company’s valuation?

In a world increasingly driven by intellectual property, the historical cost of assets reported on a company’s balance sheet often result in the value of a firm’s equity being largely disconnected from its book value.

Suppose a business is sold for of $10 million despite having only $2 million in shareholders’ equity on its balance sheet. What does the remaining $8 million in value represent? One might describe this residual value as “goodwill and intangible value” or perhaps “intangible value” or perhaps simply “goodwill”. But while these terms are sometimes used interchangeably, goodwill and intangible assets are two distinct concepts.

Intangible assets

The International Glossary of Business Valuation Terms defines intangible assets as “non-physical assets … that grant rights and privileges, and have value for the owner”.

For accounting purposes, US GAAP, IFRS, and ASPE are generally aligned in their definition of an identifiable intangible asset, though this definition differs somewhat from the one above. Under these accounting frameworks, an identifiable intangible asset must be either (a) capable of being sold on its own; or (b) arise from legal or contractual rights.

Common examples of intangible assets include:

- Brands, tradenames, or trademarks.

- Customer contracts or customer relationships.

- Technology.

- Patents.

- Recipes or formulae.

Goodwill

A firm’s goodwill is even more abstract and difficult to separate from individual intangible assets such as the examples noted above. Goodwill may result from:

- A firm’s ability to generate superior returns by being well-situated geographically (locational goodwill). It would not be surprising for a McDonald’s or Tim Horton’s franchise in a prime geographic area to generate greater earnings (and thus more value) than a store of equal size in an area with less foot traffic.

- General goodwill arising from experienced managers or employees.

- The ability to drive sales from new customers or new products or services.

- In the case of an acquisition, the ability of the acquirer to realize synergies from the target company that are unique to that individual buyer.

Personal goodwill

Sometimes, the value of a business may be driven by an owner’s unique talents, abilities, relationships, or reputation. In this case, the “goodwill” relating to that person may not be easily transferred to a new owner of the business, and debate arises as to whether there is any value attributable to this type of ‘personal goodwill’ at all.

Internally generated vs. acquired intangible assets

Intangible assets and goodwill are often classified as separate and distinct line items on a company’s balance sheet.

Goodwill arises only in an acquisition and, by default, would never be quantified on a company’s balance sheet unless that company had acquired another business at some point in the past.

Whether or not a separately identifiable intangible asset is reported on a company’s balance sheet depends on whether or not it was internally developed or acquired. Internally developed intangible assets are recognized as assets only when their cost of creation can be measured reliably. In contrast, there is a presumption that an intangible asset that is acquired as part of a business combination can be reliably measured; this process requires valuation specialists to assess how much each intangible asset — acquired in a transaction — is theoretically worth.

This dichotomy in accounting treatment can lead to differences in the reported values of intangible assets among companies depending on whether they have gone through business combinations. One of the best illustrations is comparing the balance sheet of Kraft Heinz Company to the Coca-Cola Company.

Example: Coca-Cola vs. Kraft-Heinz

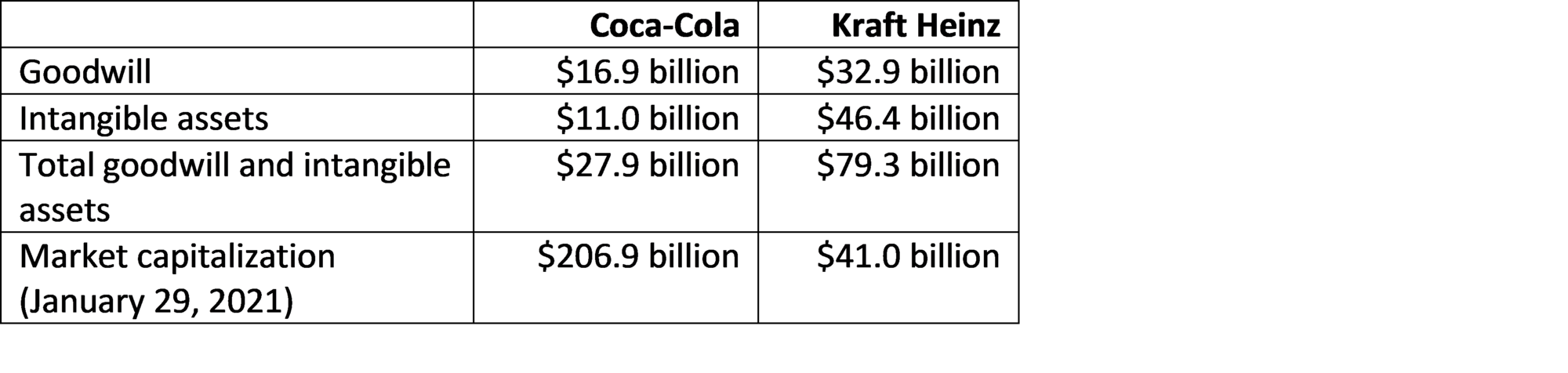

Coca-Cola is considered to be one of the world’s most powerful brands. At the end of January 2021, Coca-Cola’s total market capitalization was about $206.9 billion – roughly 10 times the $20.3 billion in shareholders’ equity reported on its most recent balance sheet. On this most recent balance sheet, Coca-Cola reported goodwill of $16.9 billion and other intangible assets of $11.0 billion. In other words, investors value Coca-Cola’s ‘goodwill’ at an amount significantly in excess of that reported on the company’s balance sheet. The reason why? Much of Coca-Cola’s intangible value has been internally developed as opposed to acquired.

In contrast, Kraft Foods Group, Inc. merged with H. J. Heinz Company in July 2015 to create the current Kraft Heinz Company. Like Coca-Cola, the Kraft Heinz Company is the owner of many well-known brands in the packaged foods space. However, its balance sheet looks much different.

Under US GAAP, Heinz was considered to have ‘acquired’ Kraft in the 2015 merger, and the business combination accounting for this merger resulted in over $78 billion recognized as additional goodwill and intangible assets on Kraft Heinz’s balance sheet. (Spoiler alert: Kraft Heinz ended up writing off a substantial amount of intangible value related to some of Kraft’s most iconic brands.)

Still, as of its most recent financial reporting, Kraft Heinz reported a lot more goodwill ($32.9 billion) and intangible assets ($46.4 billion) on its balance sheet as compared to Coca-Cola. This is despite Kraft Heinz’s market capitalization being a mere $41.0 billion at the end of January 2021 — less than 20% of Coca-Cola’s.

That Kraft Heinz reports almost three times the value of goodwill and intangible assets on its balance sheet as compared to Coca-Cola — despite trading at less than a quarter of Coca-Cola’s market capitalization — reveals the major disconnect that can result between a company’s true intangible value and the amount reported on its balance sheet. In reality, based on the market trading data, Coca-Cola’s intangible value is considerably higher than that of Kraft Heinz.

Bottom line

Goodwill and intangible assets are an important element to be considered by valuation practitioners. In quantifying the theoretical value of a business, valuators can and should consider the nature of the subject firm’s sources of intangible value.

On the other hand, financial statement users must remember what is and is not reflected in the “goodwill” and “intangible asset” figures on a company’s balance sheet. The Kraft Heinz example is a reminder that balance sheet figures are just that: one source of information, among many, that an investor may consider in valuing a firm’s equity.

Next article

What 2020 reminded us about fundamental valuation principles